How a Paystub Creator Supports Your Business Growth

Running a small business or a growing enterprise is no small feat. As a business owner, you have many responsibilities, from managing your team and tracking finances to ensuring your employees are paid accurately and on time. One of the tools that can help streamline your payroll process and ease your administrative burdens is a paystub creator.

In this blog, we’ll explore how a paystub creator can support your business growth by saving you time, improving accuracy, and enhancing employee satisfaction. Whether you’re a small business owner or a larger organization, using a paystub creator can be a game-changer for your operations.

What is a Paystub Creator?

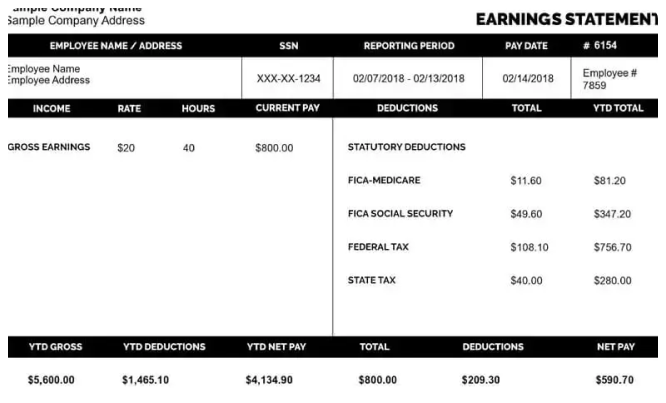

A paystub creator is an online tool or software that helps businesses generate professional pay stubs for their employees. Pay stubs are essential documents that detail an employee’s earnings, deductions, and other important payroll information for each pay period. By using a paystub creator, businesses can automate this process, ensuring that every employee receives a clear, accurate, and timely paystub.

Paystub creators typically allow you to input the following information:

- Employee Name and Address

- Hourly Rate or Salary

- Hours Worked

- Gross Pay

- Deductions (taxes, benefits, retirement contributions, etc.)

- Net Pay (final take-home pay after deductions)

This tool can be used to generate pay stubs for one-time payments or recurring payroll cycles, such as weekly, bi-weekly, or monthly.

The Benefits of Using a Paystub Creator for Your Business

1. Time Efficiency

One of the most significant advantages of using a paystub creator is the time it saves. Creating pay stubs manually can be a time-consuming and tedious process, especially if you have multiple employees. It requires attention to detail, accurate data entry, and proper calculations for each pay period.

With a paystub creator, much of this work is automated. Once you enter basic payroll information, the software does the calculations and generates accurate pay stubs in a matter of minutes. This time-saving feature frees up your HR and payroll team to focus on other important tasks that contribute to your business’s growth.

2. Accuracy and Compliance

Payroll mistakes can be costly. Errors in calculating hours worked, tax deductions, or overtime pay can lead to dissatisfied employees, potential audits, or even fines. A paystub creator helps eliminate human error by automating calculations and ensuring that pay stubs are accurate and compliant with labor laws.

In the United States, there are various state and federal requirements for payroll, including tax withholding rates, mandatory benefits, and overtime pay. Paystub creators are often designed to reflect the latest legal requirements, making it easier for business owners to stay compliant with tax laws and labor regulations. This reduces the risk of fines or penalties for incorrect payroll management.

3. Increased Employee Satisfaction

Employees appreciate transparency in how their wages are calculated. A detailed, well-organized pay stub helps them understand the breakdown of their pay, including hours worked, overtime, bonuses, deductions, and net pay. When employees can easily access this information, it fosters trust and confidence in your business.

Offering a paystub creator also ensures that employees receive their pay stubs on time, which can boost morale and prevent misunderstandings or disputes over payment. Happy employees are more likely to be productive, engaged, and loyal to your business, which is essential for growth.

4. Cost Savings

Hiring a payroll specialist or outsourcing payroll management can be expensive, especially for small businesses. With a paystub creator, you can handle pay stub generation in-house, which can be a cost-effective solution. Many paystub creation tools offer affordable subscription plans that allow businesses to generate as many pay stubs as needed for a fixed monthly fee.

For growing businesses, reducing overhead costs is crucial. By using a paystub creator, you can minimize payroll errors, avoid costly penalties, and reduce the need for additional payroll staff, all of which contribute to the bottom line.

5. Organization and Record-Keeping

A paystub creator also helps with organization and record-keeping. Proper record-keeping is not only vital for tax purposes, but it’s also necessary for audits, financial reviews, or resolving disputes with employees. Many paystub creators store pay stubs digitally, allowing you to access and retrieve past records easily.

The ability to track employee earnings, deductions, and taxes year-round makes it easier to generate reports when needed. This can help you during tax season or when applying for loans or financial assistance for business growth. It also minimizes the risk of losing critical payroll records that could be necessary for future legal or financial matters.

6. Scalability for Business Growth

As your business grows and your team expands, managing payroll can become more complex. A paystub creator grows with your business. Whether you have five employees or 500, these tools can scale to meet your needs. You won’t have to worry about outgrowing the system or dealing with manual processes that can become inefficient as you add new team members.

Additionally, many paystub creators offer features such as direct deposit integrations and tax calculation updates, making it easy to handle a growing number of employees without a significant increase in workload or additional payroll staff. This scalability is crucial for supporting your business’s long-term growth and expansion.

7. Improved Security

In an era of increasing data breaches and cybersecurity threats, safeguarding sensitive employee information is more important than ever. A paystub creator typically employs robust security features, such as encryption, to protect the personal and financial data of your employees.

By using a reputable paystub creator, you can ensure that sensitive information—such as social security numbers, bank details, and tax information—remains secure and confidential. This helps build trust with your employees and protects your business from potential legal consequences.

8. Customization for Your Brand

Many paystub creators allow for customization, enabling you to add your business’s logo, brand colors, or other identifying information to the pay stubs. This adds a professional touch and reinforces your brand identity, even in administrative tasks like payroll.

Additionally, customization can help ensure that your pay stubs meet your specific needs. Whether you need to include certain fields or adjust the format for internal purposes, a flexible paystub creator can accommodate your requirements.

9. Easy Access for Employees

In today’s digital age, employees expect quick and easy access to their pay information. A paystub creator typically offers digital pay stubs that employees can view and download online. This eliminates the need for paper pay stubs, which can be misplaced or delayed, and provides employees with instant access to their pay details.

Furthermore, many paystub creators offer secure employee portals where employees can log in, view their pay stubs, and even update personal information like tax exemptions or bank account details. This self-service functionality saves time for both employees and employers, ensuring that payroll information is always accurate and up-to-date.

How to Choose the Right Paystub Creator

With many options available, it can be challenging to choose the right paystub creator for your business. Here are some factors to consider when evaluating different tools:

- User-Friendliness: Ensure the tool is easy to use and doesn’t require extensive training.

- Customization: Check if the creator allows for customization to meet your specific needs.

- Security: Ensure the tool offers strong security features to protect employee data.

- Cost: Look for a solution that fits within your budget, considering your business size and payroll volume.

- Support: Consider customer support options in case you encounter issues with the tool.

Conclusion

A free paystub creator is a powerful tool that can support your business growth in several ways. From improving payroll accuracy and compliance to enhancing employee satisfaction and saving time, the benefits are clear. As your business grows, this tool can help streamline your payroll process, reduce overhead costs, and provide the scalability needed to handle an expanding workforce. By investing in a paystub creator, you’re not just simplifying payroll; you’re investing in the efficiency and success of your business.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season