Don’t Let Payroll Be a Headache: Try a Paystub Creator Today

Managing payroll can often feel like a daunting task. Whether you’re a small business owner, a freelancer, or part of a growing remote team, ensuring that paychecks are accurate, timely, and easy to understand is essential for maintaining employee satisfaction and staying on top of taxes. However, the process doesn’t have to be stressful. With a pay stub creator, you can streamline your payroll process, reduce errors, and make sure your employees or clients always have the documentation they need.

In this blog, we’ll explore how a paystub creator can eliminate payroll headaches, why it’s an essential tool for businesses and freelancers, and the specific benefits it offers. If you’ve been struggling with payroll or want to simplify your financial records, this post is for you.

What Is a Paystub Creator?

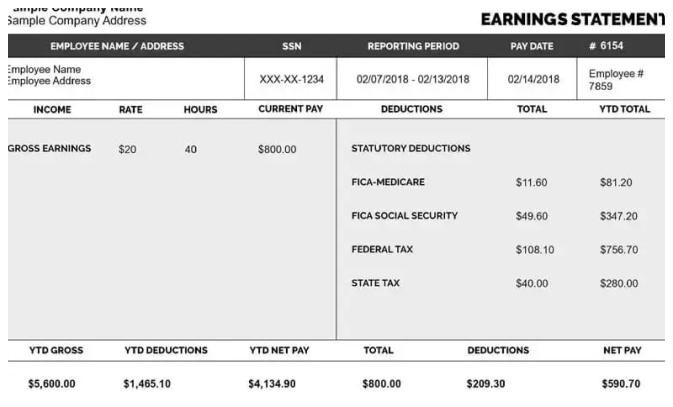

A paystub creator is an online tool that allows businesses, freelancers, and independent contractors to generate professional pay stubs quickly and easily. It enables users to input information such as employee or contractor details, wages, deductions, and taxes, and then generates a clear and organized pay stub that can be shared digitally or printed. These pay stubs act as official documentation of earnings for employees and contractors, which can be used for a variety of purposes, such as tax filings, applying for loans, or managing finances.

Paystub creators can be a lifesaver for both small business owners and freelancers. Instead of relying on complicated spreadsheets or outdated payroll systems, a paystub creator allows you to easily produce accurate pay stubs in a matter of minutes.

The Struggles of Managing Payroll Without a Paystub Creator

For many small business owners, entrepreneurs, and freelancers, managing payroll is one of the most stressful aspects of running a business. It’s easy for errors to slip through the cracks, whether it’s incorrect calculations, missing deductions, or late payments. Here are some common struggles you may face if you’re not using a paystub creator:

1. Calculating Wages and Deductions

If you’re manually calculating wages, taxes, and other deductions, the chances for error are high. Mistakes can lead to overpayments, underpayments, or discrepancies that can create problems down the line. For small businesses or freelancers working with multiple clients, it can be tough to keep track of varying rates and payment structures.

2. Keeping Track of Changes in Tax Laws

Tax laws are constantly changing, and keeping up with new requirements for payroll can be overwhelming. Incorrect tax calculations can result in fines or delays, and workers may have issues with their tax returns.

3. Lack of Transparency for Employees or Clients

Employees and contractors need clarity about their pay, deductions, and other financial details. Without clear, consistent pay stubs, workers may be confused about what they’re being paid, or worse, they might feel unsure about their employer’s payroll practices. This lack of transparency can hurt employee morale and lead to mistrust.

4. Time-Consuming and Manual Process

For small businesses or freelancers with limited resources, manually creating pay stubs or keeping track of payroll can take up a lot of time. The process of tracking hours worked, calculating pay, and generating documentation manually can be tedious and inefficient.

Why a Paystub Creator Is the Solution You Need

Using a paystub creator can make payroll stress-free and ensure that you’re meeting all your financial obligations without a hitch. Here are several ways a paystub creator can help:

1. Accurate Calculations, Every Time

One of the biggest advantages of using a paystub creator is that it automatically calculates earnings, taxes, and deductions. By inputting simple information such as hourly rates, hours worked, and applicable deductions, the tool generates accurate pay stubs in seconds. This helps eliminate human error and ensures that your employees or clients receive the correct amount.

Whether you’re dealing with a salaried worker, hourly employees, or contractors with variable pay rates, the paystub creator will handle the math for you, ensuring that all calculations are correct. No more double-checking complex spreadsheets or worrying about miscalculations.

2. Keeps You Updated on Tax Rates

A paystub creator typically includes up-to-date tax tables, so you don’t have to worry about keeping track of ever-changing tax laws. This feature ensures that your payroll complies with the latest regulations, preventing tax errors that could lead to penalties or fines. Whether you’re calculating federal, state, or local taxes, the tool does the work for you, saving you time and preventing costly mistakes.

3. Professional and Transparent Pay Stubs

A paystub creator produces clean, easy-to-read pay stubs that show a breakdown of wages, deductions, and taxes. This transparency is important for your employees or clients, as it gives them a clear understanding of what they’ve earned and how much has been deducted for taxes or other benefits.

If you’re a freelancer or contractor, these professional pay stubs can be used as proof of income when applying for loans, renting an apartment, or even filing your taxes. With a paystub creator, you can ensure that your pay stubs look organized and professional every time.

4. Saves Time and Increases Efficiency

Instead of spending hours creating pay stubs manually or relying on complicated software, a paystub creator allows you to generate them in minutes. With a few clicks, you can input payment details, calculate deductions, and have a complete pay stub ready to share. This helps save you time and energy, allowing you to focus on other important tasks in your business.

For small business owners or freelancers with multiple clients, a paystub creator allows you to generate and manage pay stubs in one place. It’s a quick and efficient way to keep payroll organized without the hassle of manual tracking.

5. Helps You Stay Organized

Managing payroll can quickly become chaotic, especially if you don’t have an efficient system in place. A paystub creator helps you stay organized by keeping all your pay stubs in one central location. You can store pay stubs for each period, ensuring that all records are accessible when needed.

If you ever need to reference past pay stubs, whether for tax purposes or financial audits, they’ll be easy to find. Many paystub creators also allow you to download, print, or email pay stubs directly from the platform, making it easier to share with employees or clients.

6. Affordable and Accessible

A paystub creator is an affordable tool for businesses of all sizes. Many platforms offer flexible pricing plans or even free versions that allow users to generate a limited number of pay stubs per month. This makes it accessible for small businesses, freelancers, and even large companies looking to streamline their payroll without breaking the bank.

Additionally, paystub creators are web-based, so you don’t need to install any software on your computer. You can access them from anywhere, whether you’re in the office, at home, or on the go.

Who Can Benefit from a Paystub Creator?

While any business can benefit from a paystub creator, there are a few specific groups of people who can particularly benefit:

1. Freelancers and Independent Contractors

Freelancers and contractors often work for multiple clients, which can make tracking earnings complicated. A paystub creator helps freelancers stay organized by providing a professional pay stub for each project or contract. This is particularly useful for proof of income, tax filing, and budgeting.

2. Small Business Owners

Small business owners can use a paystub creator to handle payroll quickly and efficiently. If you have a small team of employees or contractors, using a paystub creator reduces the chances of errors and ensures that everyone receives accurate pay documentation.

3. Remote Teams

Managing payroll for remote teams can be tricky, especially if you have employees spread across different locations. A paystub creator allows you to manage payroll remotely, without the need for complex software or physical offices. You can quickly generate and share pay stubs with your remote workers, ensuring they have the proper documentation for their earnings and deductions.

4. Part-Time or Hourly Workers

For businesses with part-time or hourly employees, a paystub creator helps track hours worked and calculate pay based on the hours input. This ensures that employees are paid fairly for the hours they’ve worked and that you’re complying with labor laws.

Conclusion

Payroll doesn’t have to be a headache. With the right tools, you can simplify the process and ensure that your employees or clients receive accurate, professional pay stubs every time. A paystub creator is an invaluable tool for freelancers, small business owners, and remote teams, providing accuracy, transparency, and efficiency when it comes to payroll management.

By using a paystub creator, you can eliminate the stress of calculating wages, managing deductions, and staying up to date on tax laws. It’s a simple, cost-effective solution that makes managing payroll easier than ever before. So, don’t let payroll be a headache—try a paystub creator today and take control of your financial documentation.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?

Understanding Your Pasadena Unified Paystub: A Quick Breakdown