How Free Paycheck Creators Can Help You Stay Compliant with Tax Laws

Managing payroll can be one of the most complex tasks for any business, whether you’re a small startup, a medium-sized enterprise, or even a freelancer. Ensuring employees receive accurate pay and complying with tax laws is crucial for avoiding costly mistakes and penalties. One essential tool that can make this process easier and more accurate is a free paycheck creator.

In this blog, we will explore how using a free paycheck creator can help businesses of all sizes stay compliant with tax laws. We’ll break down the steps involved, the importance of accurate pay stubs, and why these tools are an excellent resource for small business owners, freelancers, and contractors alike.

Why Compliance with Tax Laws is Important

Tax compliance is critical for any business in the United States. The IRS requires employers to withhold certain federal, state, and local taxes from employee wages. These deductions are essential for funding social programs like Social Security, Medicare, and unemployment insurance. If payroll is mishandled, businesses could face penalties, interest, or even legal action.

Here are some common tax-related requirements for businesses:

- Payroll Taxes: Employers must withhold federal income tax, Social Security tax, and Medicare tax from employees’ wages.

- State and Local Taxes: Some states and local jurisdictions impose additional income taxes.

- Wage and Hour Laws: Employers must ensure that they comply with minimum wage laws and overtime pay.

- Unemployment Insurance: Employers are required to pay federal and state unemployment insurance taxes.

Failing to meet these requirements not only risks fines and penalties but can also damage your business’s reputation and lead to audits.

What is a Free Paycheck Creator?

A free paycheck creator is an online tool that allows employers, contractors, and freelancers to create pay stubs for employees. These tools automatically calculate tax withholdings, deductions, and net pay, making the payroll process much easier and more accurate. Many free paycheck creators are available online, allowing users to generate professional pay stubs without needing accounting software or complicated payroll services.

These paycheck creators typically include the following features:

- Automatic Tax Calculations: The tool automatically calculates federal, state, and local taxes based on your location and payroll settings.

- Customizable Deductions: You can enter specific deductions like retirement contributions, health insurance, or other voluntary benefits.

- Pay Period Settings: You can set up pay periods, whether weekly, bi-weekly, or monthly.

- Professional Layout: Pay stubs are generated with a professional format, making them easy for both employees and tax authorities to understand.

- Records for the Future: Generated pay stubs are saved for future reference, which can be useful during audits or tax filing.

With a free paycheck creator, businesses can ensure that pay stubs comply with all applicable tax laws and meet record-keeping requirements.

How Free Paycheck Creators Help Businesses Stay Compliant

1. Accurate Tax Calculations

The most important feature of a free paycheck creator is its ability to calculate taxes correctly. The tool automatically calculates federal, state, and local income taxes based on your input, ensuring you don’t make costly mistakes.

In the U.S., payroll taxes are highly regulated. Incorrect withholding can lead to serious tax consequences. For example:

- If you withhold too little in taxes, your business could be responsible for paying the difference.

- If you withhold too much, your employees may be over-taxed, leading to dissatisfaction.

A free paycheck creator handles all these calculations for you. By entering your employees’ details (e.g., tax filing status, exemptions, and location), the software calculates the exact amount to withhold. This reduces the risk of errors that could lead to IRS fines or audits.

2. Ensures Accurate Employee Records

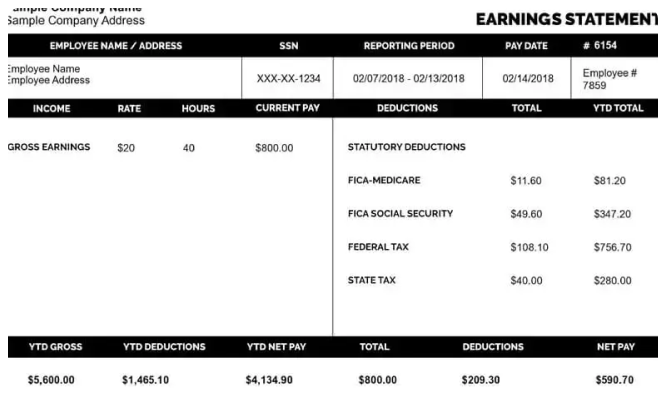

In addition to calculating taxes, a paycheck creator helps you generate accurate and organized pay stubs. Every pay stub will show:

- Gross wages (before any deductions)

- Deductions (taxes, benefits, etc.)

- Net pay (take-home pay after all deductions)

- Pay period information (start and end dates)

- Employer contributions (e.g., for Social Security, Medicare, etc.)

Maintaining accurate pay stubs is essential for tax compliance. The IRS requires businesses to keep detailed records of wages, taxes, and other payroll information for at least three years. A free paycheck creator helps ensure that your records are accurate and organized, making it easier to stay compliant with federal, state, and local tax laws.

3. Helps with Withholding Taxes for Different States

In the U.S., tax laws vary significantly from state to state. Some states have income taxes, while others do not. For businesses that operate in multiple states or have employees working remotely, a free paycheck creator can handle the complexity of calculating state and local taxes.

By inputting the employee’s work location or home address, the tool can generate tax withholding that complies with the specific state and local regulations. This is crucial for avoiding errors related to state income taxes, unemployment insurance, and other deductions. Without the right tools, this kind of work could be time-consuming and prone to error.

4. Supports Self-Employed and Freelance Workers

For freelancers and self-employed individuals, staying compliant with tax laws is equally important. Many free paycheck creators are also designed to help independent contractors by generating pay stubs that reflect their gross earnings, taxes, and other deductions.

While freelancers are not employees, they still need to track their income and tax deductions accurately. Using a free paycheck creator can help contractors track:

- Quarterly estimated taxes: Freelancers are responsible for paying their taxes quarterly to the IRS. Using a paycheck creator to generate accurate income records can help contractors calculate their estimated tax payments.

- Deductions: Freelancers can also use the tool to account for business expenses that might reduce their taxable income.

Even if you’re self-employed, a paycheck creator can simplify tax reporting and help ensure you stay compliant with tax laws.

5. Reduces the Risk of Errors

Manual payroll calculations are often prone to errors, especially when dealing with complex tax codes and varying employee benefits. A free paycheck creator reduces this risk by automating the process. The software uses up-to-date tax tables and government regulations to ensure that each pay stub is correct, reducing the chance of errors that could result in tax issues.

Furthermore, the tool generates pay stubs quickly, eliminating the potential for oversight in tax calculations. Employees will always receive accurate paychecks, and the business owner can rest assured that the correct amounts are being withheld.

6. Tax Filing and Reporting Made Easy

When it comes time to file taxes, the information from your paycheck creator can simplify the process. The pay stubs generated by these tools can be used as documentation during tax filing. You can submit the pay stubs to the IRS and your state tax authority to show how much tax was withheld from your employees’ pay.

In addition to that, many free paycheck creators allow you to generate reports that summarize payroll data for tax purposes. These reports are often formatted in a way that makes it easy to share with your accountant or use during tax season.

Benefits of Using Free Paycheck Creators

- Cost-Effective: Using a free paycheck creator eliminates the need for costly payroll services, which can be particularly beneficial for small businesses or freelancers with tight budgets.

- Ease of Use: Most free paycheck creators are designed to be user-friendly, meaning you don’t need an accounting degree to use them.

- Time-Saving: Payroll can be time-consuming, but these tools streamline the process, allowing you to generate pay stubs quickly and efficiently.

- Error-Free Calculations: Automation ensures that taxes are calculated correctly, reducing the risk of mistakes that could lead to penalties or audits.

- Professional Appearance: Pay stubs created with these tools look professional, which can enhance your business’s reputation with employees and tax authorities.

Conclusion

For businesses of all sizes, staying compliant with tax laws is not optional. Accurate tax withholdings, timely payments, and detailed record-keeping are essential for avoiding legal complications. A free paycheck creator can help simplify this process by providing businesses with accurate, professional pay stubs that ensure compliance with federal, state, and local tax laws.

By automating tax calculations, ensuring accuracy, and supporting record-keeping, these tools help you focus on growing your business while keeping your payroll compliant. Whether you’re a freelancer, a small business owner, or a manager of a larger company, using a free paycheck creator is a smart step toward reducing payroll headaches and staying on the right side of the law.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons

Why Keeping Your Starbucks Pay Stub Is Important