ETFs & Mutual Funds: A Comparison of Investment Services

Investing in the stock market is a great way to grow your wealth over the long term. However, with so many investment options available, it can be difficult to know which one is right for you. Two popular investment vehicles are Exchange Traded Funds (ETFs) and Mutual Funds. In this article, we will explore these two investment options and the services they offer.

What are ETFs?

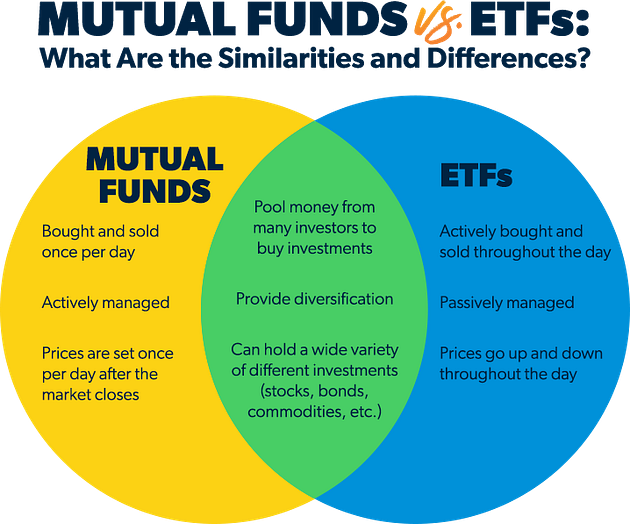

ETFs are investment funds that trade on stock exchanges. They are similar to mutual funds in that they hold a diversified portfolio of stocks, bonds, or other assets. However, unlike mutual funds, ETFs trade throughout the day on stock exchanges, allowing investors to buy and sell shares at market prices.

One of the benefits of ETFs is that they typically have lower fees than mutual funds. Additionally, because they are traded on stock exchanges, ETFs offer investors greater flexibility and control over their investments.

What are Mutual Funds?

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other assets. Unlike ETFs, mutual funds are priced at the end of each trading day and trade at their net asset value (NAV).

Mutual funds offer investors a way to diversify their portfolios without having to purchase individual stocks or bonds. Additionally, because mutual funds are professionally managed, investors can benefit from the expertise of a fund manager.

Services Offered by ETFs & Mutual Funds

ETFs and mutual funds offer investors a range of services, including:

- Diversification: Both ETFs and mutual funds offer investors a way to diversify their portfolios by holding a range of stocks, bonds, or other assets.

- Professional Management: Mutual funds are professionally managed, which means that investors benefit from the expertise of a fund manager who makes investment decisions on behalf of the fund.

- Low Fees: ETFs typically have lower fees than mutual funds, making them an attractive option for investors looking to minimize their investment costs.

- Flexibility: ETFs trade throughout the day on stock exchanges, offering investors greater flexibility and control over their investments.

- Tax Efficiency: ETFs are generally more tax-efficient than mutual funds, as they typically have lower turnover and fewer capital gains distributions.

Which is Right for You?

Deciding whether to invest in ETFs or mutual funds will depend on your investment goals, risk tolerance, and investment strategy. If you are looking for a low-cost, flexible investment option, ETFs may be the right choice for you. However, if you prefer a more hands-off approach and are comfortable paying slightly higher fees, mutual funds may be a better fit.

Conclusion

ETFs and mutual funds are popular investment options that offer investors a range of services, including diversification, professional management, low fees, flexibility, and tax efficiency. When deciding which investment option is right for you, consider your investment goals, risk tolerance, and investment strategy. With the right approach, ETFs and mutual funds can help you grow your wealth over the long term.

Do you want to To promote your business?

Get Your Business Featured at businessdor.com/get-featured/

Businessd'Or is a media company focused on business, innovation, investment, technology, entrepreneurship, leadership and lifestyle.